TAX BENEFITS

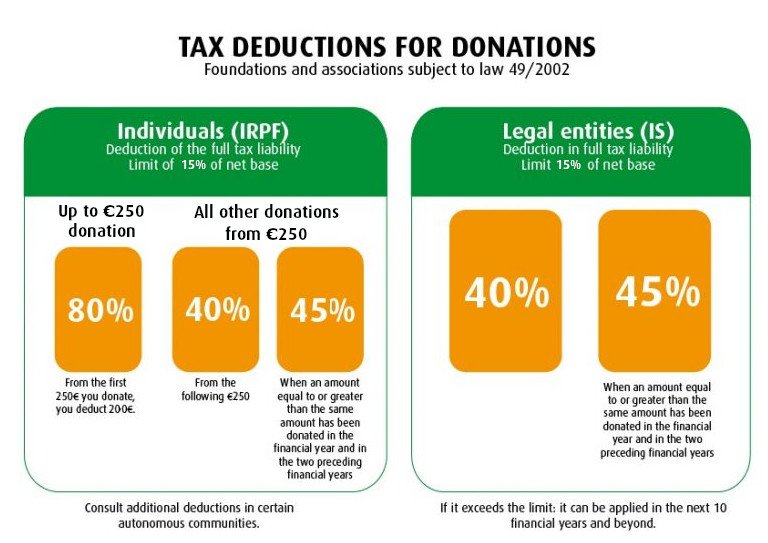

You can reduce your tax bill by up to 80% of your donation

There are new tax rules in Spain which benefit regular donors and other donors. The tax authorities now reduce your tax bill by a bigger percentage of your donation and encourage your generosity by increasing the tax savings once you have made a donation every year for three years.

DONATION CERTIFICATE

Cudeca Hospice benefits from the special tax regime for charitable entities (Ley 49/2002) and consequently you are entitled to claim an income tax deduction for your donation, reducing the income tax you pay by up to 80% of your donation.

All claims must be justified with a Donation Certificate which will be issued by Cudeca Fundación on receipt of the donation. The receipt must show all the personal data to be supplied by the donor: first name and surname, NIF (Tax Number Identification), email and postal address.

A Donation Certificate will be sent by post mail to donors who have supplied this data. Individuals or companies who have made a donation through bank transfer or other means, should contact by telepnone 952 564 910 or by email to socios@cudeca.org indicating the date, amount and account number of the transfer and donor´s first name and surname, together with NIF reference to enable us to locate the donation and issue the Certificate.

The Certificates can be issued up to the 31st December of the donation year. Therefore it is very important to request the Certificate supplying the correct data before that date. In accordance with Tax Office (Agencia Tributaria) legislation it will not be possible to issue Certificates after this date has passed.